Tava

Type

Product Design

Year

2018

Tava is a product concept developed by CaixaBank about collaborative payments. CaixaBank has been developing digital products for years that solve the needs of its clients.

In 2016 CaixaBank created ImaginBank, which is the first Spanish bank born 100% managed by mobile. The objective of CaixaBank is to offer young users the facilities to manage all their accounts through the channel they use the most and through this be able to attract half a million new users until the end of 2017.

What is the context?

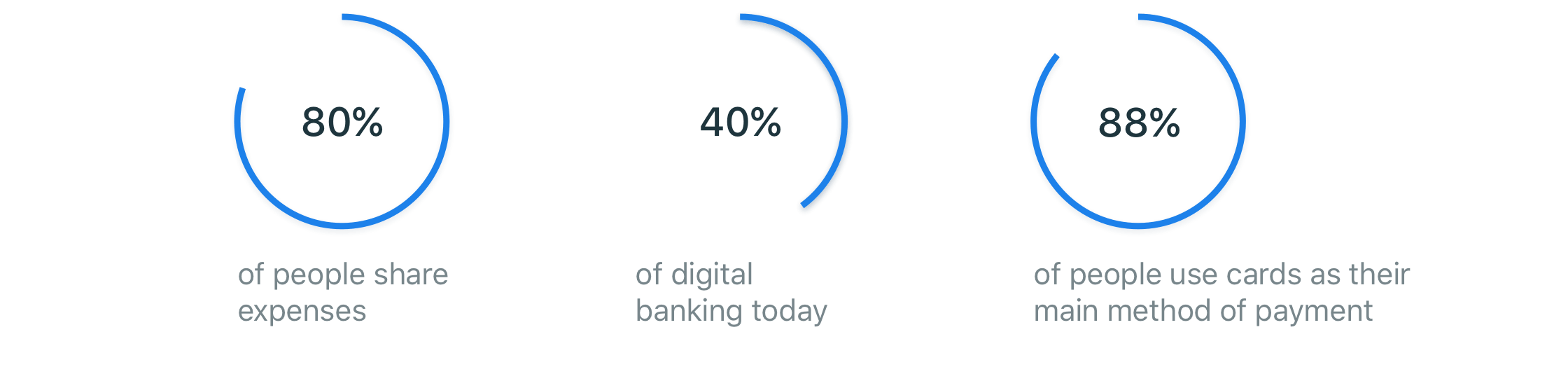

The society is changing in the way of making payments; 10 years ago the people managed their own economy and no expenses were shared.Today, with the emergence of platforms that offer collaborative services, the society has the need to do collaborative payments with other people.

What is our market?

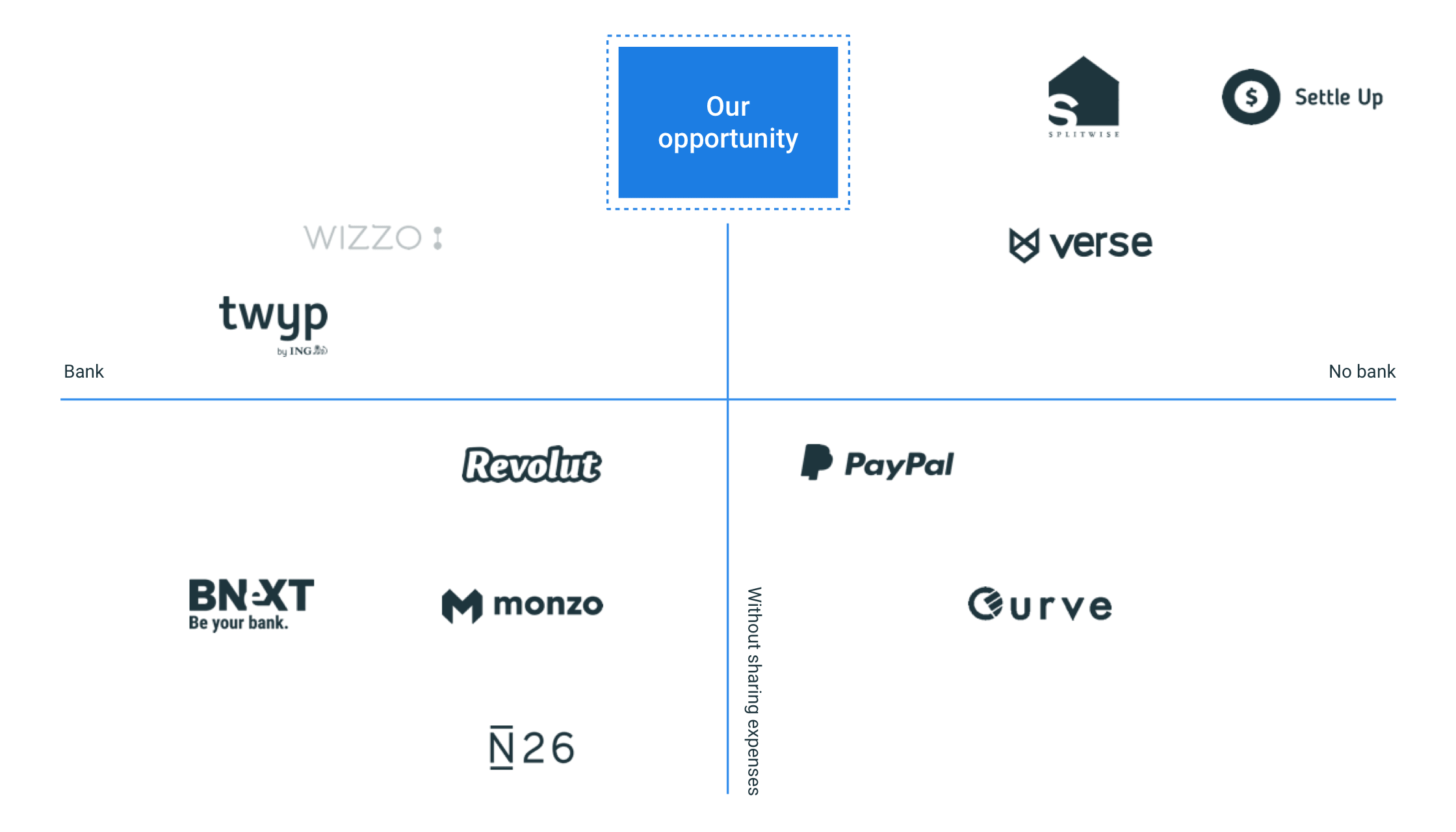

In the current market of collaborative payments we find two aspects; The bank lends facilitates payments between people and the applications that help the user to manage payments with his friends. But these two aspects aren’t connected and I believe that the opportunity of CaixaBank would be to create a product that would facilitate the payment method to the users and at the same time help manage the accounts.

What are the problems?

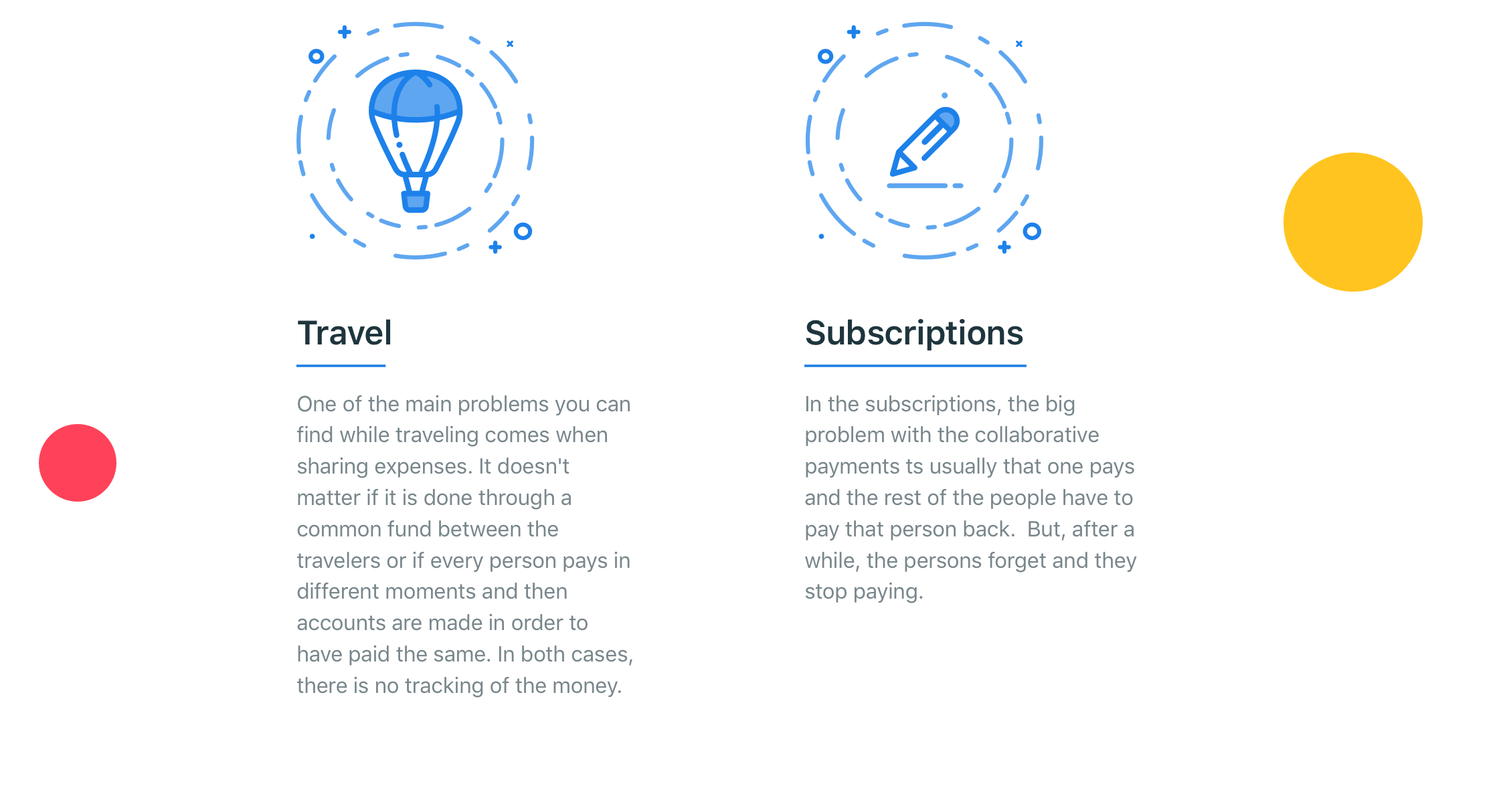

While doing a research, there were found several situations where users needed to make collaborative payments.

What is our objective?

-Give to the users a product that solves the problems they have when making collaborative payments.

-Create a product to increase CaixaBank's business by 12%.

How are we going to do it?

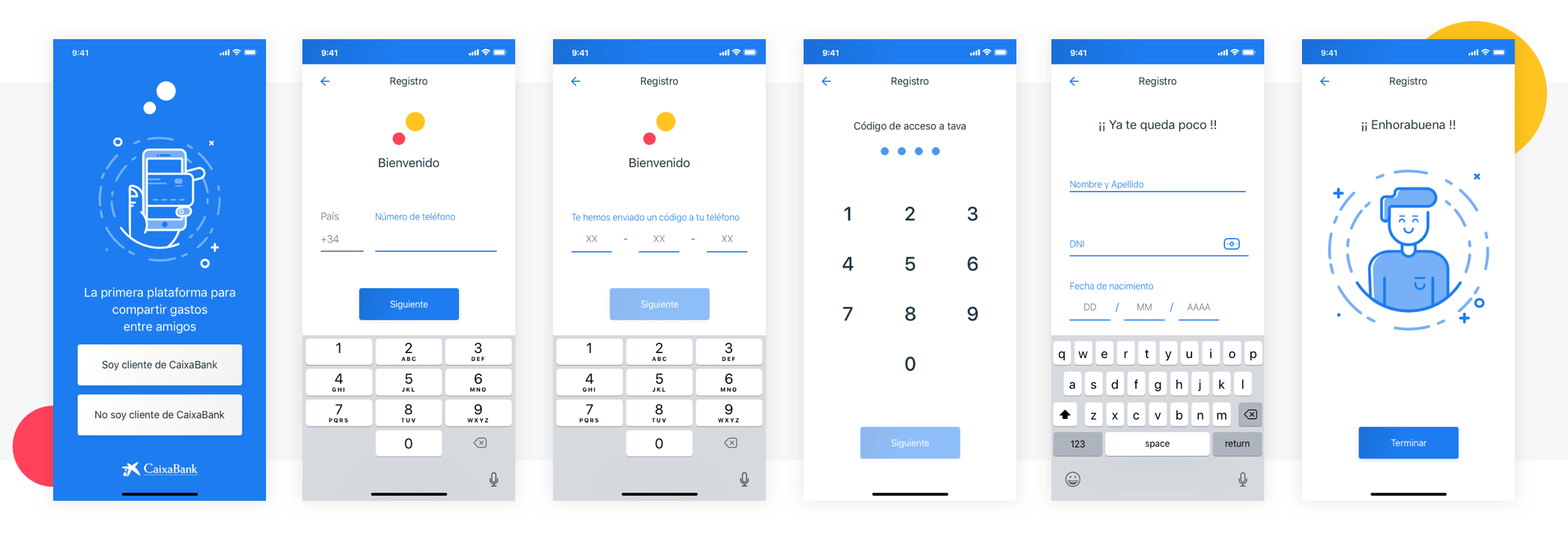

With an app called tava, where users of any bank can link their cards to a common tava account.

How does the app work?

Any user of any bank can create an account in tava, in this way CaixaBank reaches out new and potential customers.

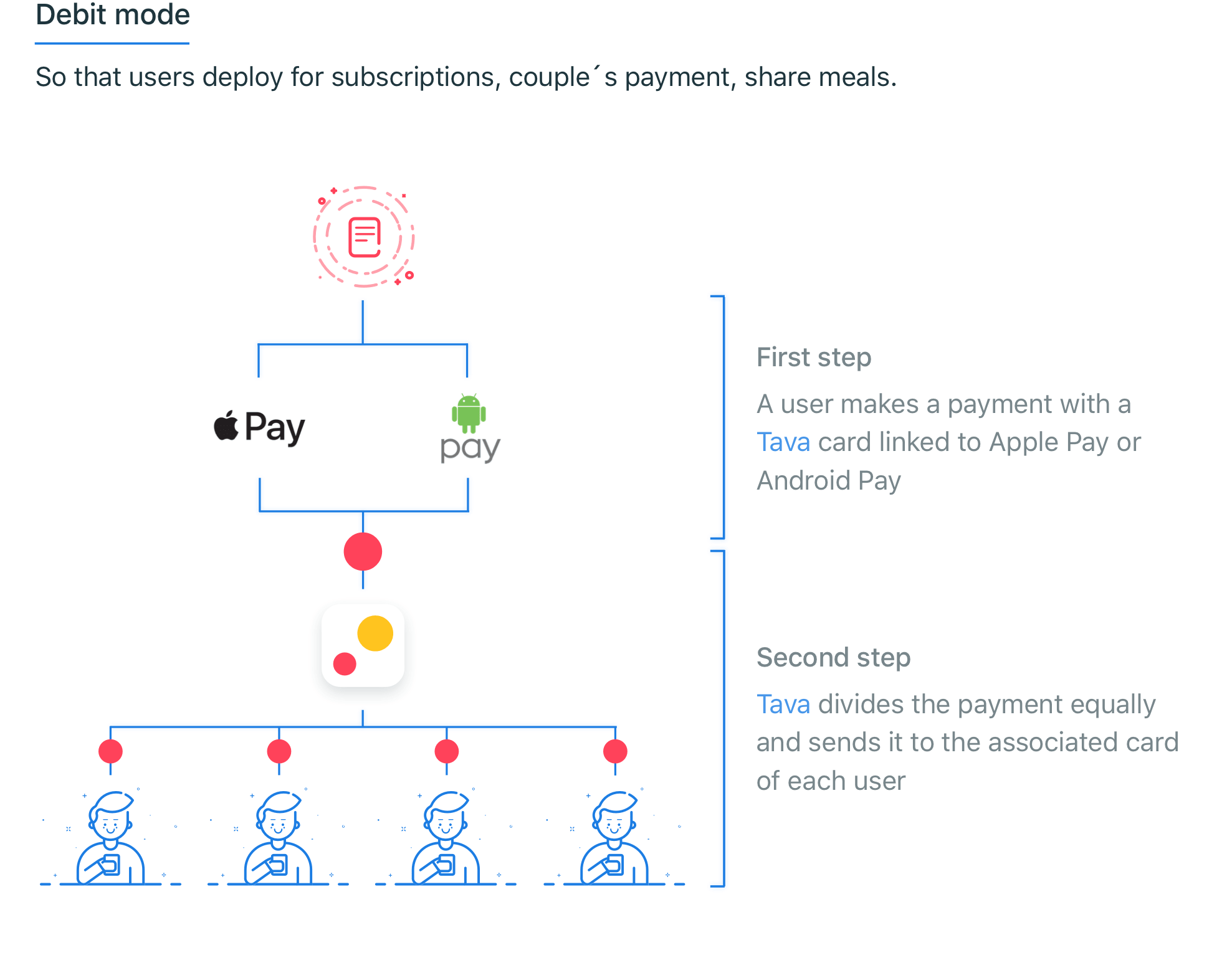

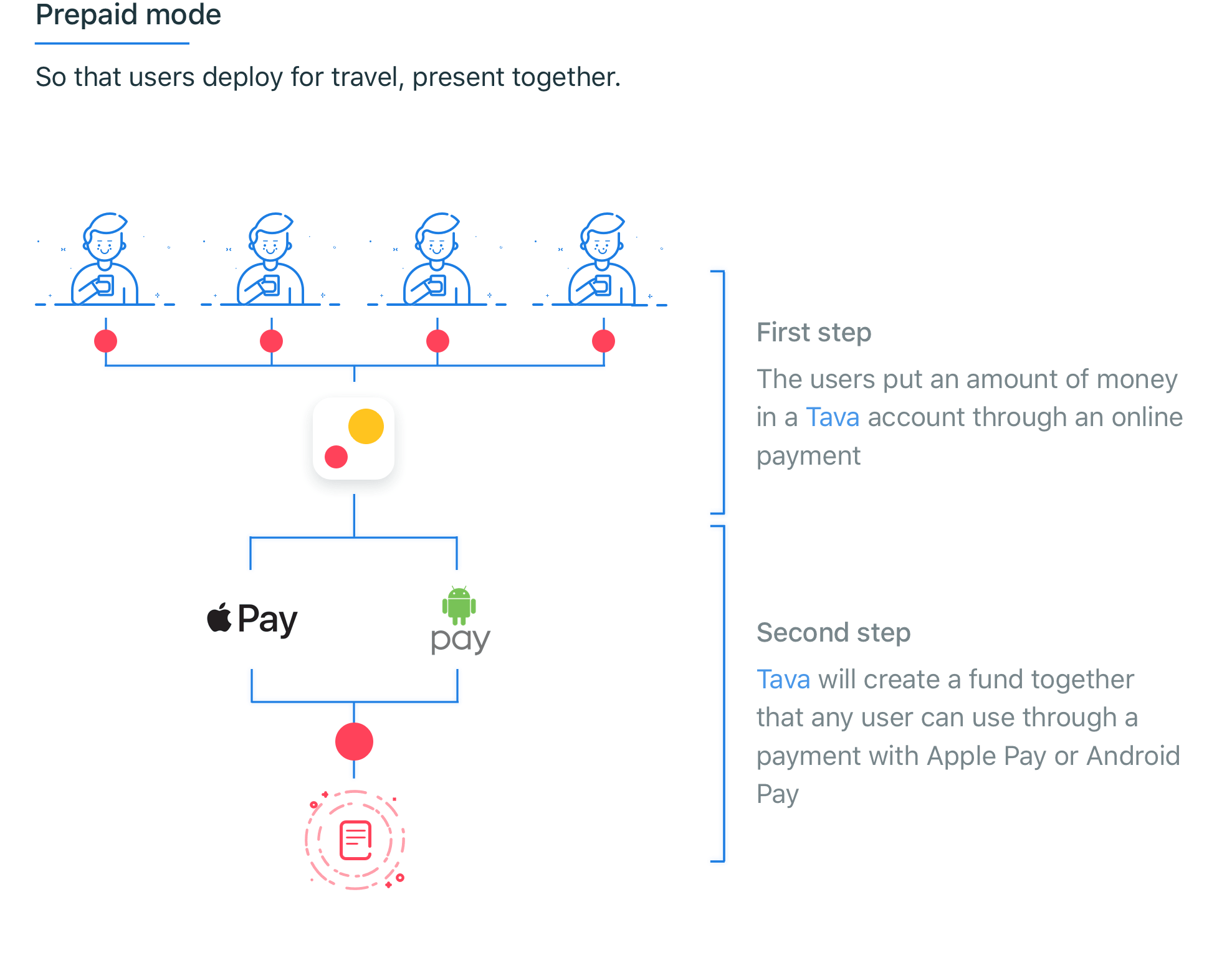

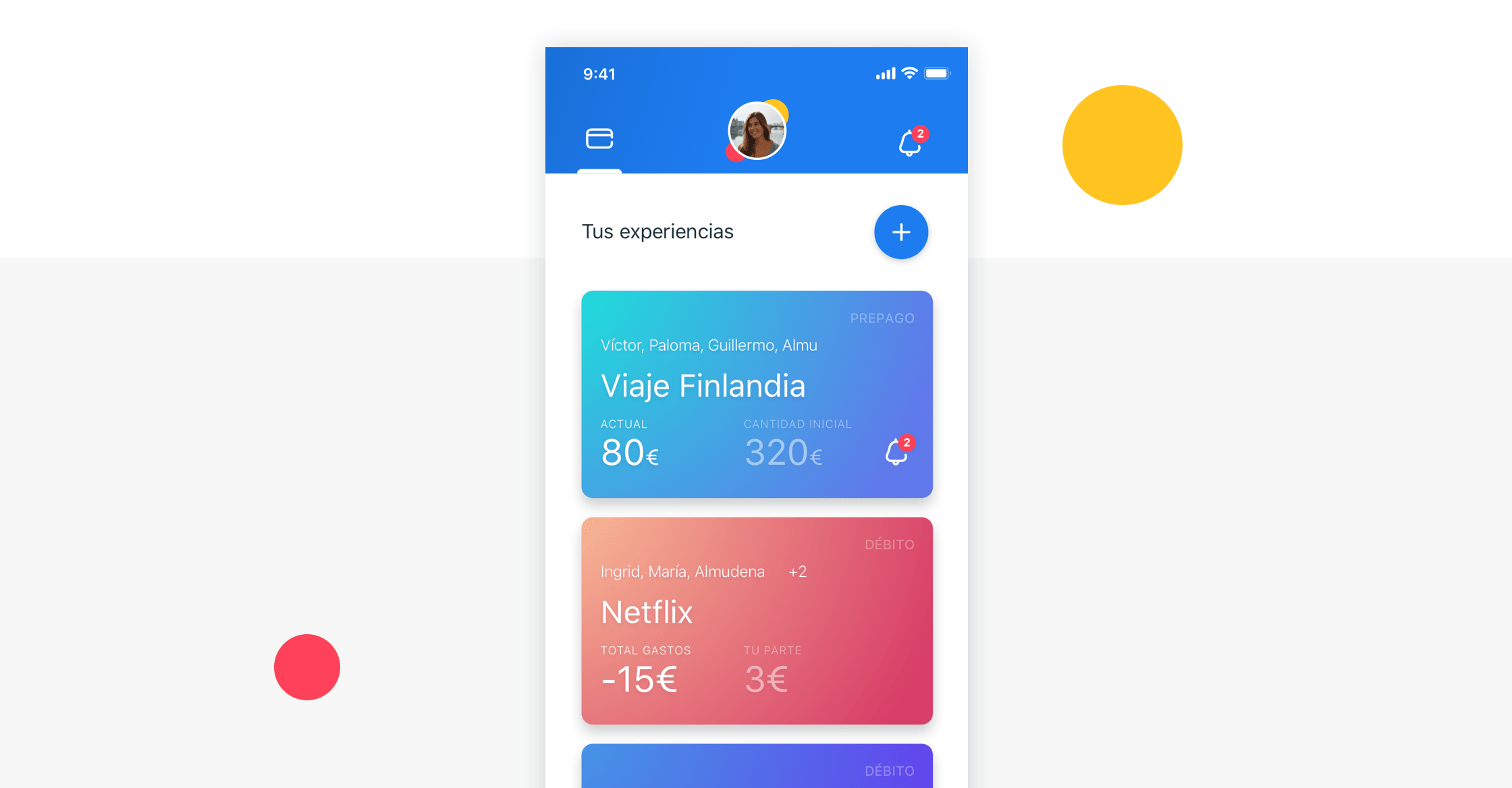

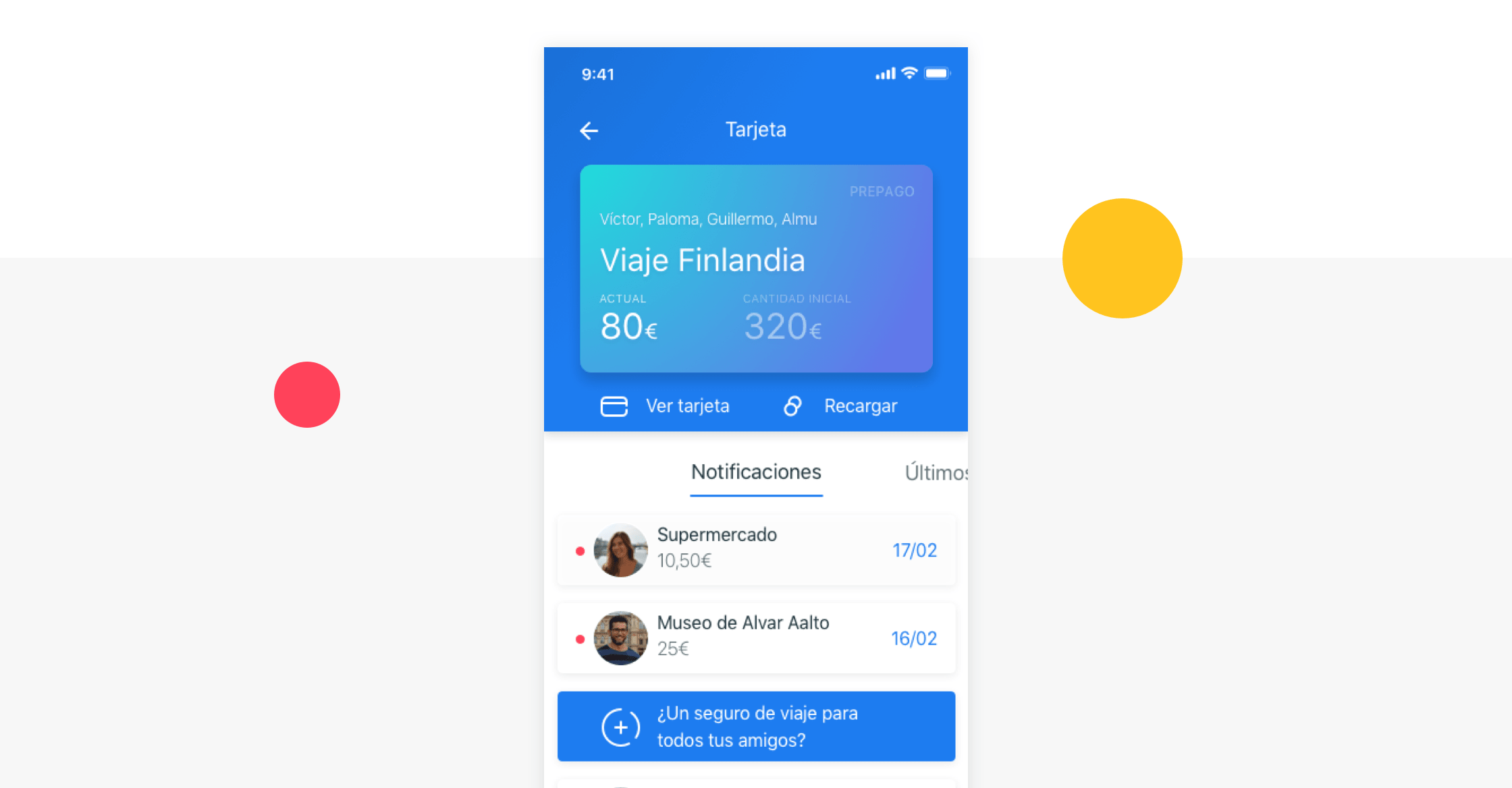

With Tava you can create as many cards as you want to enjoy them with your friends. Each card will be configured according to the needs of the users.

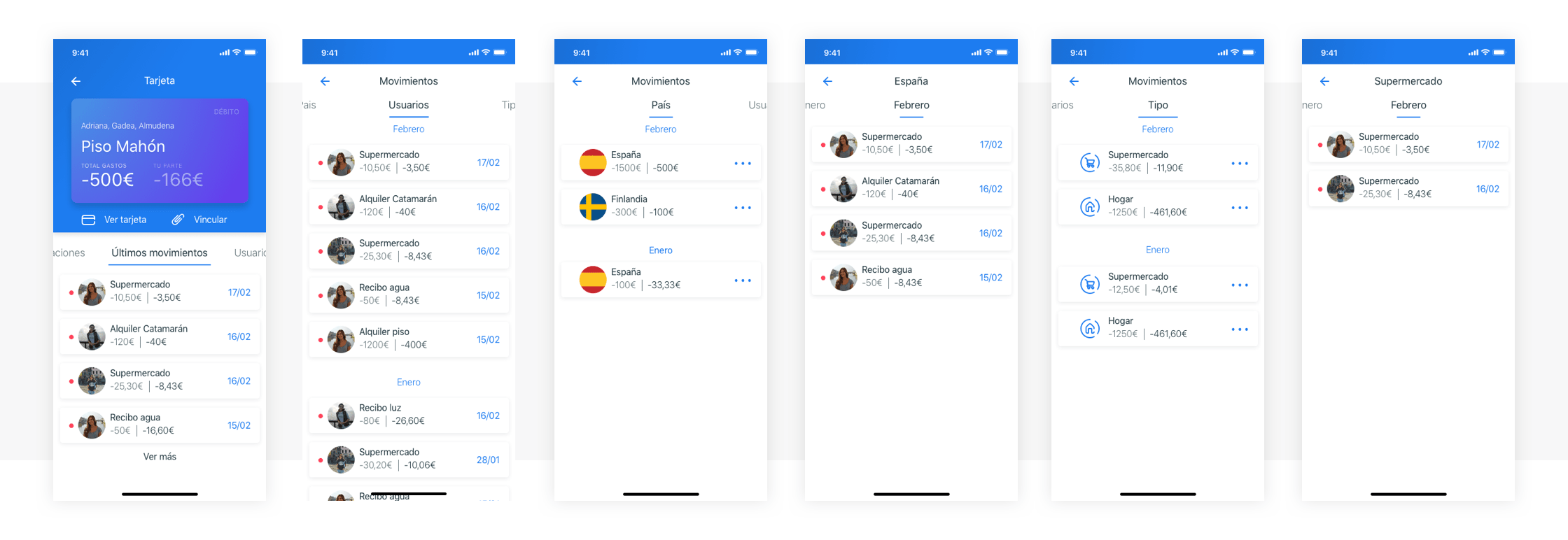

Tava will make it easier for users to see where each expense is made; keeping track of who is spending the money, locating the country from where the expense is made or by grouping the expenses to know where more money is spent.

By knowing how and by who the card is being used, Tava can offer specific CaixaBank products to its users; For example, if the account is being used to share a flat, it will offer you home insurance.

Tava will allow you to have financial relationships between friends.